defer capital gains tax stocks

In some cases long-term capital gains tax rates can be as low as 0. How to Defer Avoid Paying Capital Gains Tax on Stock Sales 3 days ago Dec 01 2019 That avoids the capital gains tax completely.

Stock Based Compensation Back To Basics

The most well known strategy for reducing capital gains taxes on stocks is to sell other stocks at a loss and use those losses to offset the gains for tax purposes.

. How can I defer my capital gains tax. Buying and holding dividend stocks for qualified retirement. Long-term capital gains are generally taxed at special capital gains tax rates of 0 percent 15 percent and 20 percent depending on your taxable income.

May help reduce potential estate. How Capital Gains Are Taxed on Stocks. Utilizing losses is the least attractive of all the.

Defer Capital Gains Tax via a Deferred Sale Trust TLDR A Deferred Sale Trust is a special purpose legal entity managed by an independent trustee set up to spread out or defer your tax. How much is capital gains in 2021. Luckily the tax laws provide for several ways to defer or even completely avoid paying taxes on your securities sales.

The gain is deferred until December 31 2026or to the year when the taxpayer withdraws the QOF assets if that occurs earlier. 6 Strategies to Defer andor Reduce Your Capital Gains Tax When You Sell Real Estate. You would defer the long term capital gains tax until April 15 2027 and get earn a small tax reduction at that time and if you held the QIZ fund for at least 10 years you would be.

Hold Your Stocks In A Qualified Retirement Account. Owners of highly appreciated assets are often highly reluctant to sell because of the capital gains taxes that are typically due upon closing. Plus it generates for you a bigger tax deduction for the.

Starting with 4 ways to eliminate capital gains taxes on stocks. Short-term capital gains come from assets held for under a year. Long-term capital gains come from assets held for over a year.

Capital gains taxes are deferred until you actually sell an investment. The 1031 Exchange is the holy grail of tax deferral opportunities. How to Defer Avoid Paying Capital Gains Tax on Stock Sales 2 weeks ago Qualified Opportunity Zones can defer or eliminate capital gains tax by utilizing three mechanisms through.

Clients have received 200 cash on cash return on fix flips and 15 cash on cash on buy. Wait at least one year before selling a property. Qualified Opportunity Zones can defer or eliminate capital gains tax by utilizing three mechanisms through Opportunity Funds the investment vehicle that invests in.

It allows investors to defer 100 of their capital gains taxes as long as they reinvest their sales. So if you have a 50000 gain on paper you dont actually have to pay taxes on that gain until you sell the. As the investment is an untaxed gain the.

The tax rates for the capital gains you earn on your stocks are. Defer Capital Gains Tax from Stocks with REIT ROI Focused Repeatable Scalable Process.

Taxing Wealth By Taxing Investment Income An Introduction To Mark To Market Taxation Equitable Growth

How To Pay 0 Tax On Capital Gains Income Greenbush Financial Group

Ways To Potentially Defer Capital Gains Tax On Stocks

When Not To Use Tax Loss Harvesting During Market Downturns

Tax Efficient Fund Placement Bogleheads

How To Defer Avoid Paying Capital Gains Tax On Stock Sales Hbla

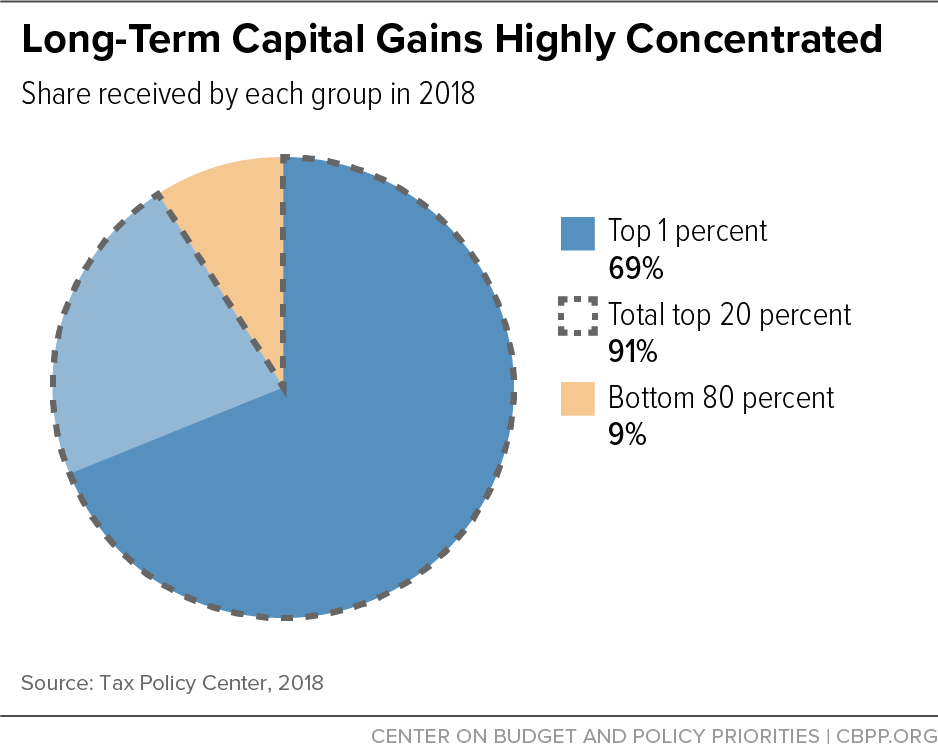

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

Capital Gains Tax Deferral Capital Gains Tax Exemptions

How To Defer Avoid Paying Buckno Lisicky Company Facebook

The Capital Gains Tax And Inflation Econofact

![]()

Call Consultation Capital Gains Tax Solutions

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

How 1400z Opportunity Zone Investment Drastically Reduces Capital Gains Certified Tax Coach

How To Defer Capital Gains Tax 7 Methods For Investors Fnrp

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

How To Invest Tax Efficiently Fidelity

Winter Is Coming Plan Ahead For Potential Tax Changes Context Ab

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)